Tariffs Shake the Market—But Bay Area Home Prices Continue to Climb | March 2025 Housing Market Update

- DW HOMES

- Apr 22, 2025

- 2 min read

Updated: Sep 3, 2025

Are Trump’s new tariff policies causing stock market volatility? Absolutely. But surprisingly, Bay Area home prices are still on the rise. In this March housing market update, we break down what’s really happening and what it means for buyers, sellers, and investors across the Bay Area.

Tariffs Trigger Uncertainty—But Real Estate Remains Resilient

A series of reciprocal tariff measures introduced by former President Trump has caused significant uncertainty in the financial markets. The result? A sharp drop in the S&P 500 and increased volatility in equities.

During turbulent times, investors often shift capital to safer assets—such as bonds and real estate. Meanwhile, tariffs on essential building materials like steel and lumber are pushing construction costs higher, directly impacting homebuilders and the new construction market.

But here’s the twist: luxury real estate demand is holding strong, as affluent buyers seek tangible assets to hedge against economic instability. And with mortgage rates dipping slightly due to broader financial trends, many see this as a timely buying opportunity.

Bay Area Real Estate Market Snapshot:

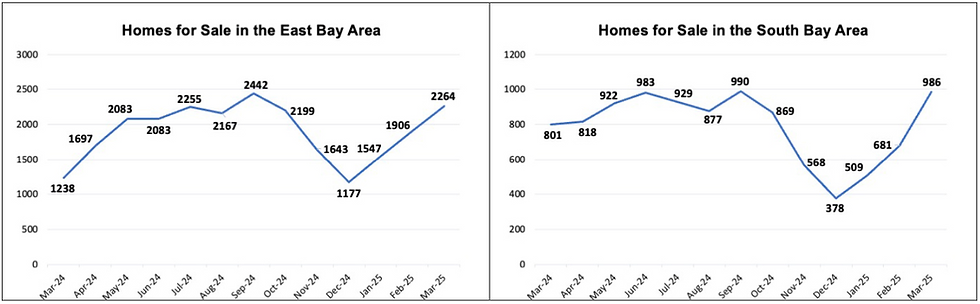

Last month, the East Bay market had an average of about 2,264 listings, an increase of over 900 compared to the same period last year; the South Bay had around 986 listings, up about 185 year-over-year.

The East Bay had a medianhome price of $1.2 million, slightly higher than the same period last year; the South Bay's median price was $2.12 million, an increase of about $220,000 year-over-year.

In terms of sales volume, the East Bay recorded 1,219 transactions, an increase of over 100 compared to last year; the South Bay saw 664 transactions, remaining about the same as last year.

Neighborhood Highlights:

I-880 Corridor:

Listings Surge: Newark and Union City saw 3x more listings.

Price Spike: Albany home prices jumped by 53%.

Sales Growth: Union City sales volume doubled.

Central Contra Costa:

Listings increased across the board: with Pleasant Hill up 1.4 times year-over-year.

Most home prices declined: with Pleasant Hill being the only exception, rising 14%.

Clayton’s sales volume surged 86% compared to the same time last year.

LAMORINDA:

Inventory Up: Moraga and Orinda both saw 2x more listings.

Price Movements: Orinda -4%, Moraga +13%.

Sales Up: Lafayette and Moraga up by 13%.

三谷地区(Tri-Valley):

Listings Up Across the Board: Pleasanton and San Ramon listings tripled.

Price Changes: Most cities down slightly, San Ramon up 21%.

Strong Sales:San Ramon sales volume up 47%.

南湾城市:

Listings Increase: Los Altos and Sunnyvale both up over 50%.

Prices Climb: Campbell, Los Altos, and Palo Alto each saw 20%+ price growth.

Big Sales Jump: Los Altos sales up 130% YoY.

Data from March shows that homes in the East Bay stayed on the market for an average of 13 to 15 days, while homes in the South Bay sold in just about 9 days. However, since April, with a new round of tariff policies taking effect, market reactions indicate that the sales cycle is starting to lengthen. We’ll provide further analysis once the April data is released.

While these tariff policies present challenges for the market, they also create new opportunities. If you have any questions or thoughts about this update, feel free to leave a comment or contact us directly.

Comments